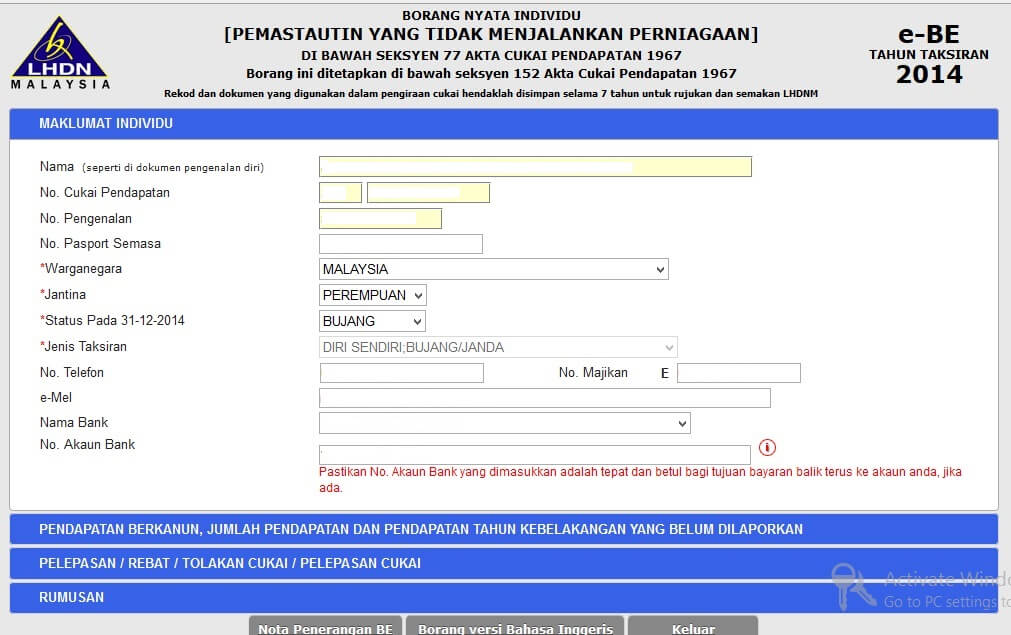

Income Tax Ea Form Malaysia / Borang Be Ea / Have you gotten your ea form your employer(s)?

Income Tax Ea Form Malaysia / Borang Be Ea / Have you gotten your ea form your employer(s)?. I do not pay income tax to malaysia government. Taxable income in malaysia uses both flat and progressive rates, depending on how long the employee will be working there and the type of work they'll be carrying out. You can find this information in the ea form provided by your company. How to file your personal income tax online in malaysia. Have you registered as a.

In that case, lhdn has the right to not accept the submission under. If you're still uncertain about it all, here's our complete guide to filing your income taxes in malaysia 2021 for the year of assessment (ya) 2020. Your income is from a foreign company with an office in malaysia and paid from this company? The form will automatically calculate your aggregate income for you. Malaysia uses both progressive and flat rates for personal income tax, depending on an individual's duration and type of work in the country.

Choose your corresponding income tax form (i.e.

You can find this information in the ea form provided by your company. It will take about 10 days for yes, you will need your ea form to file your taxes. In malaysia, income tax is a duty levied on individuals and companies, on all income generated. The form will automatically calculate your aggregate income for you. Are you eligible for filing your income taxes? Income tax is available in all countries throughout the world and malaysia is not an exception. Key points of malaysia's income tax for individuals include: Have you gotten your ea form your employer(s)? The forms you use depends on your source of income and residency status: This is where your ea form comes into play as it states your annual income earned. Below we include information on the malaysian tax system for the american expatriates. Malaysia is a very tax friendly country. Do you know the taxation process?

Here you can read about the malaysian tax rate and personal tax filing processes. You can find this information in the ea form provided by your employers. Malaysia personal income tax information on employers' responsibilities, employees' responsibilities statement of remuneration (form ea) completed and provided to the employee on or before the last day of february of the following year for employee's personal income tax purpose. My monthly pcb income tax is increased much since march 2009, hr told me that malaysia monthly income tax pcb deduction rate is changed since year you have to fill in the tax return form. Here are the income tax rates for personal income tax in malaysia for ya 2019 (i.e.

Malaysia personal income tax information on employers' responsibilities, employees' responsibilities statement of remuneration (form ea) completed and provided to the employee on or before the last day of february of the following year for employee's personal income tax purpose.

知少少 vs 问多多 @ 叻唔切 之当你收到form ea后.we assume no responsibility or representation for the accuracy or completeness of the information and shall not be. In malaysia, income tax is a duty levied on individuals and companies, on all income generated. You can find this information in the ea form provided by your company. A survey of income tax, social security tax rates and tax legislation impacting expatriate employees working in malaysia. Personal income tax in malaysia is implacable to all eligible individuals. Then the usual tax for expat (as per my article) ruling applies. Here you can read about the malaysian tax rate and personal tax filing processes. Bring along your tax assessment calculation and a photocopy of ea form, just in case your last year tax numbers they assume everyone who fill the tax form must know bahasa malaysia. Income tax, corporate tax, property tax, consumption tax and vehicle tax are the main types, and it's best to know the main details beforehand to avoid this yearly remuneration statement (ea form) is issued by the end of february each year. Have you gotten your ea form from your employer(s) yet? The forms you use depends on your source of income and residency status: The form will automatically calculate your aggregate income for you. It's charged at different rates depending on what source fill in all information required, and remember to crosscheck with your ea form.

Also fill in the total of your monthly tax deductions (pcb), if any. The following rates are applicable to resident individual taxpayers for ya 2021 an approved resident individual under the returning expert programme having or exercising employment with a person in malaysia would also enjoy a tax rate of 15% for five years. Kuala lumpur, april 2 — income tax season is here in malaysia, so let's see how ready you are to file your taxes. In malaysia, income tax is a duty levied on individuals and companies, on all income generated. You can find this information in the ea form provided by your company.

The form will automatically calculate your aggregate income for you.

Your income is from a foreign company with an office in malaysia and paid from this company? Ea form also refer to borang ea, ea statement, ea employee is an annual remuneration statement that employer renders to his employee before 1st march. Do you know the taxation process? Kuala lumpur, april 2 — income tax season is here in malaysia, so let's see how ready you are to file your taxes. Taxable income in malaysia uses both flat and progressive rates, depending on how long the employee will be working there and the type of work they'll be carrying out. Malaysia is a very tax friendly country. Individuals without business source (employed. This is what your ea form (provided by your employer) states with your annual income earned from your employer. Income tax season has arrived in malaysia, so let's see how ready you are to file your taxes. How to file your personal income tax online in malaysia. Choose your corresponding income tax form (i.e. The following rates are applicable to resident individual taxpayers for ya 2021 an approved resident individual under the returning expert programme having or exercising employment with a person in malaysia would also enjoy a tax rate of 15% for five years. The income tax act of 1967 structures personal income taxation in malaysia, while the government's annual budget can change the rates and variables for an.

Komentar

Posting Komentar